Lafayette TN Insurance provides vital protection for residents in Lafayette, TN, offering a variety of coverage options to meet individual needs. From understanding the importance of insurance to finding affordable policies, this comprehensive guide explores all aspects of insurance in Lafayette, TN.

Overview of Lafayette, TN Insurance

Insurance plays a crucial role in the lives of residents in Lafayette, TN, providing financial protection and peace of mind in the face of unforeseen events. There are various types of insurance coverage available in Lafayette, TN, including auto insurance, home insurance, life insurance, and health insurance. When selecting insurance in Lafayette, TN, residents should consider factors such as coverage limits, deductibles, premiums, and the reputation of the insurance provider.

Local Insurance Providers in Lafayette, TN, Lafayette tn insurance

In Lafayette, TN, residents have access to several prominent insurance companies, including State Farm, Allstate, Farmers Insurance, and Liberty Mutual. These insurance providers offer a range of services and coverage options tailored to the needs of Lafayette residents. Customer reviews and feedback can help residents make informed decisions when choosing an insurance provider in Lafayette, TN.

Insurance Policies Tailored for Lafayette, TN Residents

Popular insurance policies among Lafayette, TN residents include comprehensive auto insurance, homeowners insurance with coverage for natural disasters, and health insurance plans with local healthcare providers. These policies address unique needs and risks specific to the Lafayette area, such as tornadoes, floods, and rural healthcare access. Insurance policies in Lafayette, TN may differ from those in other regions due to the local environment and demographics.

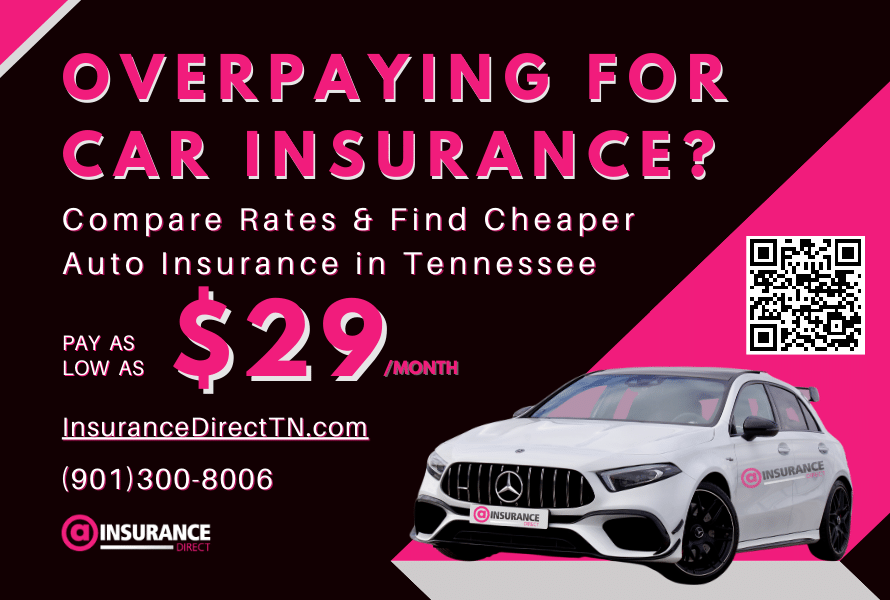

Tips for Finding Affordable Insurance in Lafayette, TN

Residents in Lafayette, TN can save money on insurance premiums by bundling policies, maintaining a good credit score, and taking advantage of discounts offered by insurance providers. Additionally, comparing quotes from multiple insurers can help residents find the best coverage at competitive rates. By maximizing insurance coverage while minimizing costs, residents can ensure financial security in Lafayette, TN.

Wrap-Up

In conclusion, Lafayette TN Insurance plays a crucial role in safeguarding residents against unforeseen circumstances, while also offering opportunities to save on premiums. By exploring the diverse insurance options tailored for Lafayette, TN, individuals can make informed decisions to protect their assets and loved ones effectively.

FAQ Compilation: Lafayette Tn Insurance

What are the common types of insurance coverage available in Lafayette, TN?

Common types of insurance coverage in Lafayette, TN include auto insurance, home insurance, life insurance, and health insurance.

How do insurance policies in Lafayette, TN differ from those in other regions?

Insurance policies in Lafayette, TN may offer specific coverage tailored to the unique needs and risks of residents in the area, such as protection against natural disasters common to the region.

Are there any special offers or discounts available for insurance policies in Lafayette, TN?

Some insurance providers in Lafayette, TN may offer discounts for bundling multiple policies or for maintaining a good driving record.