Errors and omissions insurance for bookkeepers is a crucial aspect of their profession. This insurance provides protection against potential mistakes or negligence, ensuring financial security and peace of mind. Let’s delve into the details of this important coverage.

What is Errors and Omissions Insurance for Bookkeepers?

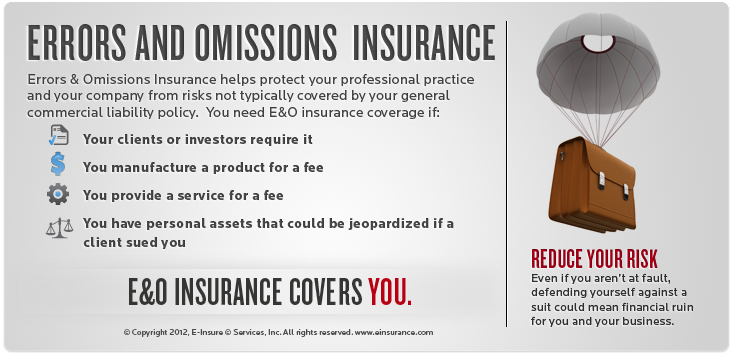

Errors and Omissions Insurance for Bookkeepers, also known as Professional Liability Insurance, is a type of insurance that provides protection to bookkeepers against claims of negligence, errors, or omissions in their professional services. This insurance coverage is essential for bookkeepers to safeguard themselves from potential lawsuits and financial liabilities.

Importance of Errors and Omissions Insurance for Bookkeepers

Errors and Omissions Insurance is crucial for bookkeepers as it protects them from legal claims and financial damages resulting from mistakes or oversights in their work. Without this coverage, bookkeepers could face significant financial losses, reputation damage, and legal fees.

- Errors in financial statements

- Misclassification of expenses

- Failure to meet deadlines

Coverage Areas in Errors and Omissions Insurance Policies

Errors and Omissions Insurance policies typically cover legal defense costs, settlements, and judgments that arise from claims of professional negligence, errors, or omissions. The coverage may include protection against claims related to data entry errors, miscalculations, and other mistakes in financial reporting.

How to Choose the Right Errors and Omissions Insurance Policy for Bookkeepers?

When selecting an Errors and Omissions Insurance policy, bookkeepers should consider factors such as coverage limits, deductibles, policy exclusions, and claims history. It is essential to compare different insurance providers and their offerings to find a policy that best suits the specific needs of the bookkeeping business.

Factors to Consider When Choosing an Errors and Omissions Insurance Policy

- Professional experience and expertise

- Scope of services provided

- Client base and industry specialization

Assessing Insurance Needs, Errors and omissions insurance for bookkeepers

Bookkeepers can assess their insurance needs by evaluating the potential risks associated with their services, considering the financial implications of a claim, and seeking advice from insurance professionals. It is essential to tailor the insurance policy to address specific risks and exposures faced by the bookkeeping business.

Cost Considerations for Errors and Omissions Insurance for Bookkeepers

Errors and Omissions Insurance costs for bookkeepers can vary based on factors such as coverage limits, deductibles, claims history, and the size of the business. Premiums are typically calculated based on the level of risk associated with the bookkeeping services provided. Bookkeepers can manage insurance costs by implementing risk management strategies and comparing quotes from multiple insurance providers.

Cost Structure and Premium Calculations

Errors and Omissions Insurance premiums are calculated based on the bookkeeper’s annual revenue, claims history, coverage limits, and deductible amounts. Bookkeepers can lower their premiums by maintaining a clean claims history, implementing quality control procedures, and enhancing their professional credentials.

Strategies to Manage Insurance Costs

- Reviewing coverage limits and deductibles

- Implementing risk management practices

- Seeking discounts or incentives from insurance providers

Claims Process for Errors and Omissions Insurance: Errors And Omissions Insurance For Bookkeepers

Filing a claim for Errors and Omissions Insurance involves submitting a detailed claim form, supporting documentation, and working closely with the insurance provider to investigate the claim. Bookkeepers should prepare a strong claim by documenting the incident, providing evidence of the error or omission, and demonstrating compliance with professional standards.

Steps in Filing a Claim

- Notify the insurance provider of the claim

- Submit the claim form and supporting documents

- Cooperate with the claims adjuster during the investigation

Reasons for Denied Claims

Errors and Omissions Insurance claims may be denied due to lack of coverage, policy exclusions, or failure to meet policy conditions. Bookkeepers can avoid claim denials by understanding their policy coverage, complying with policy conditions, and maintaining accurate records of their work.

Final Wrap-Up

In conclusion, errors and omissions insurance for bookkeepers is a vital safeguard that every professional in this field should consider. By understanding the coverage, costs, and claims process, bookkeepers can make informed decisions to protect their business and reputation.

FAQ Compilation

What does Errors and Omissions Insurance for Bookkeepers cover?

Errors and Omissions Insurance typically covers legal fees, settlements, and judgments that arise from claims of professional negligence or mistakes made by bookkeepers.

How can bookkeepers reduce the cost of Errors and Omissions Insurance?

Bookkeepers can lower insurance costs by maintaining accurate records, implementing risk management practices, and comparing quotes from different insurance providers.

What happens if a claim is denied?

If a claim is denied, bookkeepers can appeal the decision or seek legal advice to understand the reasons behind the denial and explore potential next steps.