Delving into Humana Medicare Supplement Insurance Plans, this introduction immerses readers in a unique and compelling narrative. With a focus on comprehensive coverage options, readers will gain valuable insights into the benefits and advantages of choosing Humana as their insurance provider.

Overview of Humana Medicare Supplement Insurance Plans

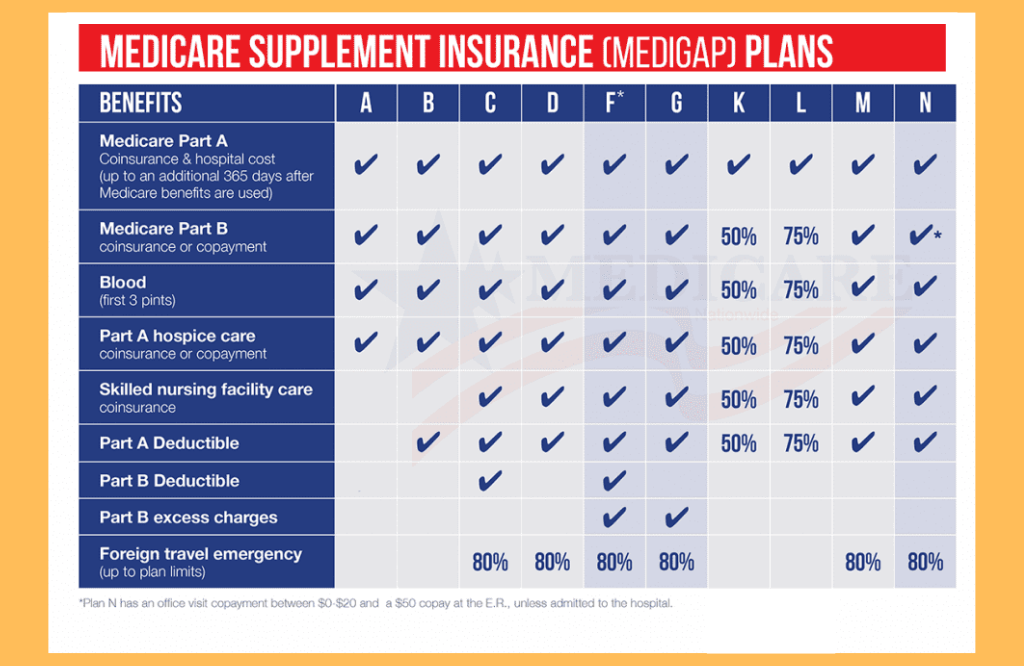

Humana Medicare Supplement Insurance Plans provide additional coverage to fill the gaps left by Original Medicare. These plans help cover expenses such as copayments, coinsurance, and deductibles that are not covered by Medicare alone. Compared to other insurance providers, Humana offers a variety of coverage options to meet individual needs, providing flexibility and peace of mind to beneficiaries. Choosing Humana Medicare Supplement Insurance Plans can offer access to a wide network of healthcare providers and facilities, ensuring quality care for policyholders.

Coverage Options

| Plan Type | Coverage | Benefits |

|---|---|---|

| Plan A | Basic benefits covering Medicare Part A coinsurance and hospital costs | Provides coverage for hospice care coinsurance or copayment |

| Plan F | Covers all gaps in Medicare coverage | Includes Part B deductible, foreign travel emergency coverage, and excess charges |

| Plan G | Similar to Plan F but does not cover Part B deductible | Offers comprehensive coverage for Medicare beneficiaries |

Choosing the right plan depends on individual needs and budget. For example, Plan F may be beneficial for those who want comprehensive coverage, while Plan G could be a more cost-effective option for others.

Enrollment Process

Enrolling in Humana Medicare Supplement Insurance Plans is a straightforward process. To enroll, individuals can visit the Humana website or contact a licensed insurance agent. The steps include selecting a plan, completing the application form, and providing necessary personal information. Eligibility requirements may vary by state, so it’s essential to review specific guidelines before enrolling.

Cost and Pricing

Humana Medicare Supplement Insurance Plans offer competitive pricing compared to other insurance providers. The cost of the plans is determined based on factors such as age, location, and selected coverage options. Factors like tobacco use and health status may also affect pricing. It’s important to compare costs and benefits to choose a plan that fits your needs and budget.

Network Coverage, Humana medicare supplement insurance plans

Humana Medicare Supplement Insurance Plans provide access to a broad network of healthcare providers and facilities. Policyholders can choose from in-network providers for lower out-of-pocket costs. The network includes hospitals, doctors, specialists, and other healthcare professionals. Additionally, some plans offer out-of-network coverage for flexibility in choosing providers outside the network.

Final Wrap-Up

Conclusively, Humana Medicare Supplement Insurance Plans offer a wide range of coverage options, competitive pricing, and a robust network of healthcare providers. With a seamless enrollment process and exceptional customer service, choosing Humana ensures peace of mind and reliable coverage for your healthcare needs.

Answers to Common Questions: Humana Medicare Supplement Insurance Plans

Are there any restrictions on which healthcare providers I can see with Humana Medicare Supplement Insurance Plans?

Humana Medicare Supplement Insurance Plans offer a broad network of healthcare providers, but it’s important to check if your preferred providers are included in their network to ensure coverage.

How does pricing work for Humana Medicare Supplement Insurance Plans?

Pricing for Humana plans is determined based on various factors, including your location, age, and the level of coverage you choose. It’s advisable to compare different plans to find one that fits your budget and needs.

Can I enroll in a Humana Medicare Supplement Insurance Plan outside of the initial enrollment period?

While the best time to enroll is during the initial enrollment period, certain circumstances like losing other coverage may qualify you for a special enrollment period to sign up for a Humana plan.